A new report published in June 2018 shows that UK companies are well-placed to supply valuable materials needed for batteries to be built in UK – a potential £2.7 billion per year business opportunity. The report commissioned by WMG at the University of Warwick, was launched to the Chemical Industry Association at the Chemistry Growth Partnership meeting in London, chaired by Steve Foots, Chief Executive of Croda, and attended by Richard Harrington MP.

The research underpinning the report brought together experts and data from the automotive battery industry and chemicals industry, working in the context of the UK’s Industrial Strategy, points to a large UK battery manufacturing industry opportunity. The report was funded by EPSRC, commissioned and managed by WMG at the University of Warwick acting in their role as the Advanced Propulsion Centre Electrical Energy Storage Spoke, and delivered in partnership with E4tech. WMG’s Professor David Greenwood, one of the report’s authors said:

“This report details a massive opportunity to grow a UK battery chemicals industry and related supply chain. The UK’s Industrial Strategy identified battery development and manufacture as one of the four initial Grand Challenges to coalesce industrial activity upon high growth opportunities. Battery pack manufacturing for electric vehicles (EVs) will logically take place close to the point of vehicle assembly since packs are hard to transport. This in turn implies that the battery cells which make up the packs will best be manufactured in (or close to) the UK. This could also mitigate the loss of vehicle engine production.”

“However for cell production to occur in the UK, the supply chains of chemicals would need to be reconfigured, since most cell production and chemicals supply is currently in Asia. Whilst such components could be imported, to capture the most value cell production and the related chemical and process equipment supply would need to come from UK suppliers.”

The report notes that the UK manufactured 1.7m cars in 2016, around 80% of which were exported (SMMT 2017). Assuming that 50% of the vehicles manufactured in 2030 are electrified vehicles (EVs and PHEVs), and taking into account the expected falls in battery cost, the corresponding value of cell materials per car will be £3,200, worth £2.7bn per year to the UK chemical industry just for UK-built cars, with export potential to Europe of ten times that.

This would see a UK vehicle battery industry requiring these volumes of materials in any one year:

| Cell material |

Annual UK value (£ million) |

Annual UK volume |

| Cathode active material |

1,040 |

69,000 t |

| Anode active material |

538 |

48,000 t |

| Separator |

394 |

263 million m2 |

| Electrolyte |

359 |

27,000 t |

| Anode copper foil |

215 |

18,000 t |

| Electrode binders, solvents and additives |

72 |

10,000 t |

| Cathode aluminium foil |

72 |

10,000 t |

The report makes a range of observations and recommendations that would be key to ensuring that the UK can capitalise on this significant opportunity.

• The battery chemicals supply chain is a highly additional opportunity for the UK chemicals sector. Seizing it will require the automotive battery and chemicals industries to work very closely, guided by the Faraday Challenge.

• UK battery manufacturers find that sourcing process equipment from outside the UK is not a problem but sourcing materials, especially those used for conventional lithium ion batteries, poses supply security issues. UK battery technology developers are currently sourcing their materials from outside the UK and are not facing particular challenges from a supply chain point of view, given the small scales and novel materials

• Conducting joint R&D with technology developers could be a way into the battery supply chain for UK chemical companies, provided they can supply battery-grade materials at scale

• Companies are unclear on exactly what products the battery industry will require, on what scale and when but research such as this can help them plan for a clear future.

• Under current conditions, companies are looking at strategies to enter the battery supply chain that minimise risk, such as adapting existing products, developing new products that can have multiple applications, or conducting R&D activities co-funded by public grants

• Only a few UK companies are already supplying the battery industry at scale. Those who are not will need time, once the business case is made, to develop new products and the necessary production capacity as the typical time to market for new products in the chemical industry is in the order of 2 years

• Many indicated building close partnerships with developers of new battery technology as their preferred strategy, allowing them time to grow and gain competitive advantage over suppliers to current battery technology manufacturers

• Certainty in the UK battery market is essential to enable investment in chemical production plants

• In addition to support for EV adoption and battery manufacturing, perceived risk in the development of the chemicals and process supply chain also needs to be addressed. Support provided should last long enough for the supply chain to reach critical mass

• Supporting the growth of our smaller / SMEs companies could ensure resilience within the UK economy. Funding is required (potentially through Faraday) to engage with these industries to help them de-risk and make the transition into this new sector

The full report can be found here

Note for Editors:

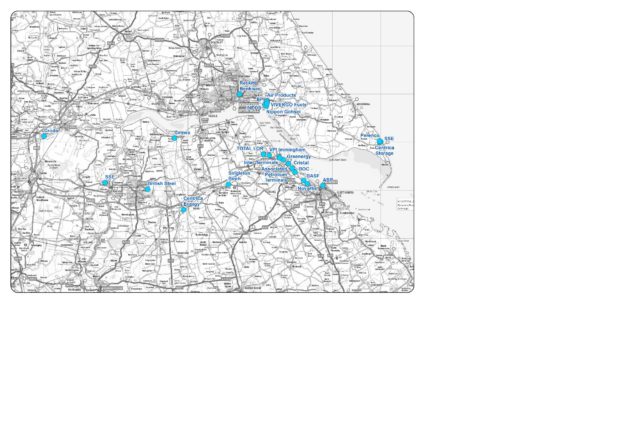

This report was commissioned and supported by the Electrical Energy Storage APC Spoke at WMG, University of Warwick and is the output of a project that combined organisations focused on the automotive battery and chemicals industries in UK. It was funded by EPSRC (The Engineering and Physical Sciences Research Council) and closely supported by the UK Chemistry Growth Partnership and the Knowledge Transfer Network. The consultancy work and this report were executed by E4tech. The Centre for Process Innovation provided input and review, especially on UK suppliers of relevant chemicals and processes. Sixty seven other organisations, listed in the appendix, took part in the interviews and workshop informing this work.

About WMG: WMG is a world leading research and education group and an academic department of the University of Warwick, established by Professor Lord Kumar Bhattacharyya in 1980 in order to reinvigorate UK manufacturing through the application of cutting edge research and effective knowledge transfer.

WMG has pioneered an international model for working with industry, commerce and public sectors and holds a unique position between academia and industry. The Group’s strength is to provide companies with the opportunity to gain a competitive edge by understanding a company’s strategy and working in partnership with them to create, through multidisciplinary research, ground-breaking products, processes and services.

About the APC: The Advanced Propulsion Centre (APC) exists to position the UK as a centre of excellence for low carbon propulsion development and production. The Advanced Propulsion Centre was formed in 2013 and is a £1 billion, ten-year commitment between